It’s time to get the pile of magazines off my desk which serve as a daily reminder of ESG, Dr. Evil’s newest creation. If I can just write this post, wasting as few words as possible, I promise myself and you to return to technical topics. Writing my notes about ESG has been kind of like cleaning up after my dog. A nasty job that has to be done.

To kick it off, or rather, away, here are the U.N. 2015 Sustainable Goals in a pretty little chart prepared by it:

These Goals are all either misdirected, wrong-headed or nonsense. Goals 1 -4 seem like a smokescreen, are practically speaking unobtainable for all, and really aren’t the business of world government. Genders are not equal (Goal 5) last I checked, nor should they be. Goals 6 – 10 are exactly what big government and industry have failed to deliver, and will continue to fail on as long as monopolies are encouraged by both, and permitted to exist by a drugged, complacent people. Goals 11 -13 are actually kind of dark. Cities are about as sustainable as mines. Anyway, Goal 11 is a euphemism for packing people into small, controllable spaces and doing stuff to them like making them drink their own wastewater. And who is going to determine what constitutes responsible production and consumption, Goal 12? We already know that laboratory meat and plant-based yuk are getting a big push, especially from super-nerd/pervert Bill Gates and his yachting, jetsetting ilk. I don’t need some control freak telling me what to eat because some one-sided climate religion-funded research paper objects to methane or nitrogen emissions.

Goal 13 is the elephant in the room: The current big push is about Net Zero. That’s our present focus since we are on board with diversity and equity and all that by now thanks to “mostly peaceful” riots in 2020. Well, let’s continue on… Goals 14, 15 – whhhh…at? How do 5G ocean stations and thousands of satellites bombarding the earth with RF fit into that? And Goal 16 is totalitarian government in league with oligarchical corporate and NGO (tax exempt) entities. Which brings us to Goal 17 (Yay!) It’s the public-private stakeholders (oink-oink). Stakeholder capitalism is communism. Oh, and that last box in the chart with the all of the colors…maybe if you stare at it long enough you get hypnotized.

The Useful Idiots

What’s the impact on mining of these Rio accords, or Paris, or Tokyo, or whatever conclave ginned up this pile of dung? Here’s how it comes down to we mining professionals: Almost every issue of our trade journals has a pep-talk, a get-on-board with Agenda Hell in the form of ESG. Taking a sample of just the last few months:

January, 2022 Mining Engineering: “Diversity and inclusion in mining”

January, 2022, E&MJ,”Battery Power Charges Ahead”

April, 2022 Mining Engineering: “Coal and Sustainable Development”

June, 2022 E&MJ: “Building Better Mining Companies Through ESG”, and “Riding the Risks and Opportunities of ESG in Mining”

In the latter article, we have helpful subheadings like “Realizing Decarbonization Goals”. Companies that are not on board are not “mature”. We are informed that miners are moving “away from fossil fuels.” Among other stupid posits, we are invited to think about exploring for something besides gold: “ ..what is the company looking for? Exploring for critical metals that are vital to the energy transition, or polymetallic deposits that include them, is easier to justify from a social perspective than exploring for a commodity such as gold or coal”, and “Miners who can prove that they are building a better world and are critical to a net-zero (italics mine) future, can improve their recognition within global markets and society, and create value for all stakeholders.” Newmont comes to mind, doesn’t it (cough…evil empire…cough)? Net-zero is the thing, huh? And that is good because…? Let’s also explore the term “recognition”. Does that mean “recognition” by Blackrock, Vanguard and State Street, the companies who decide to invest in you based on your ESG score (what’s that?)??? And the “stakeholders” (see Goal 17 above): That Pope guy in Rome who is all about “stakeholder capitalism” comes to mind. Stakeholders like George Soros, Rockefeller Foundation, Bill and Melinda Gates Foundation, Defense/Wellcome Trust/ Big Ag. Not you, oh no, you aren’t on the Board. As George Carlin advised long ago: “It’s a big club, and you ain’t in it.” We are “stakees.”

The E&MJ European editor is credited for the articles listed above. She also is apparently an expert on energy efficiency based on credit for another highly technical article in the issue. Is it possible that the ESG articles are a plant? Maybe, but ESG is such a tsunami that there is a blurred line between externally imposed and auto-generated propaganda. The citations in the E&MJ articles include studies by consulting firms whose raison d’être is expressly ESG. Everybody is in on this — all of the major consulting firms. The magazines cited are just playing to the audience, or cheering them on. It’s the same language disseminated through the press, the companies, and our professional societies to enlighten us all.

Coercion is a central aspect of Goals 16 (Peace and Justice) and 17 (Partnerships for the Goals). What does our E&MJ article say? “Ultimately, miners that can demonstrate their societal value will strengthen their relationships with stakeholders and be rewarded in the marketplace with cheaper capital and financing costs…” And E&MJ is going to help you get a better personal ESG score by supplying this helpful article. Miners will be squeezed and choked financially, and shunned by investors (all three of them) unless they toe the line with Net Zero, sustainability (???), diversity and inclusion policies, and generous trinkets for the natives from whose lands they extract their stuff.

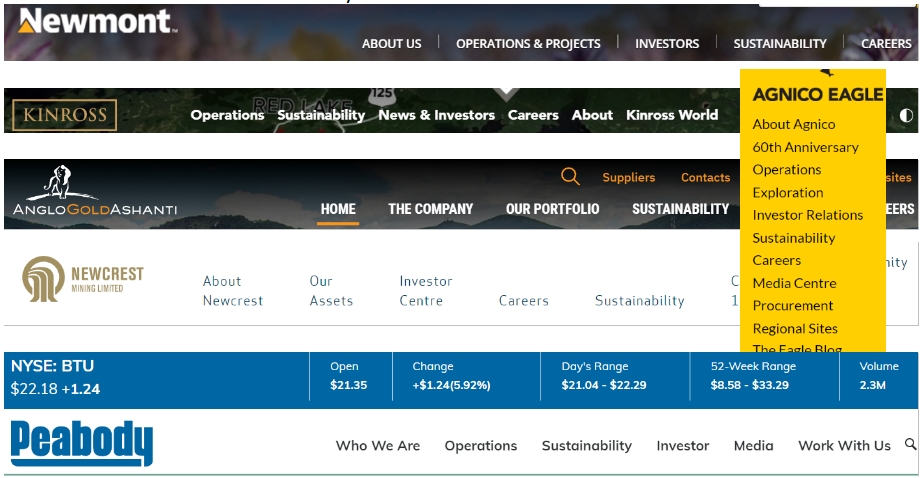

Let’s check the website banners for key words (hint: Sustainability):

How about that Peabody web banner? In their Statement on Climate Change they say: “Peabody has a responsibility to reduce our GHG emissions to fulfill our company ambition of achieving net-zero emissions by 2050.” So, Peabody is going out of business, but not until everyone has forgotten this statement because no one will have any lights to read it. I didn’t open the “Who We Are” tab after reading the Sustainability one. But it makes you wonder.

Then we have the National Mining Association’s statement on ESG which speaks for itself: “Mining plays a critical role in providing responsibly produced raw materials that make modern life possible and fuel America’s economic growth. These products are vital to society, including its transition to a low-carbon future.” The NMA affirms its commitment “…to reduce emissions consistent with the best available science.” Actually, do we detect some partially concealed skepticism embedded in its statement? Maybe the science won’t support the “green” transition, just maybe?

We Have Laws

Almost every country has environmental and social laws to protect its people. These aren’t equal in each country, and they are certainly not perfect. Mining companies will make terrible local messes if they are not regulated. We know this from all of the legacy issues remaining from as little as 50 years ago in this country. I once worked for a company that legally dumped its mill tailings directly into the Coeur d’Alene River for most of a century until 1969, some of that time producing under government contract. That was ignorance, carelessness and greed at play. After all, such behavior was illegal in Colorado by the 1930’s. As far as extralegal corporate behavior, my experience has shown me that corrupt governments and their courts, as well as national and corporate cultures of corruption result in lack of enforcement of laws already on the books. Corporations, their executives and government officials are rarely held accountable, and often their own policies are reactive, rather than pro-active. On the other hand, I worked for a company that profitably mined for 10 years in the State of Washington and cleaned up after itself so immaculately that only someone who knew the history of the property could now detect any sign that the mine ever existed. Because the company was led by ethical managers who cared.

Even when Corporations try to do a good job they are often frustrated with a changing regulatory environment and political maneuvering. It’s a bit concerning when companies waste money showing off when their purpose is profit. Posturing might benefit one company over another, but it doesn’t create real jobs and wealth. ESG is posturing and pandering. What’s going to happen when the flawed national regulatory framework is replaced with an even more arcane world government?

ESG and We

I am surprised at the number of blank stares I get from people I meet when I mention ESG. And even many people who have been introduced to the term, thanks to being employees of public firms, don’t really make the personal connection. ESG is now firmly wrapped around the financial throat of every company and it’s coming for mine and yours. It’s a huge pig trough populated by large consulting companies and software vendors, government agencies, NGO’s and non-productive corporate employees. As the Heartland Institute advises in its ESG is Not Part of a “Free-Market” Economy white paper, “…there is additionally evidence suggesting that individuals and families will soon be directly affected by ESG metrics, especially those related to the environment.” For example, your food, your car, your travel, you name-it.

With business, a quick internet search will give you the ESG score of any company. It seems like some of these scoring systems are arbitrary, but I am too impatient with all of this to do more research on scoring. If a company fails in one category, they shout how well they are doing in another. Each rating agency, all seemingly self-proclaimed, comes up with a different score. If a company has a poor score it is not included in ESG portfolios or ETF’s. Fewer investors buy your stock and there’s trouble. Banks won’t lend to low-ESG scorers because this is now equated with “risk”. The scoring systems are intended for all and are now even being applied to individuals; e.g., those who bank with Merrill Lynch/Bank of America. When we add up the vaccine passports, proposals to install remote kill switches in vehicles, the push for digital currency, smart-everything and for continuous biometric monitoring (beware smokers!), it all points to a society that looks more like China every day. Low ESG score? No air travel for you!

I remember my shock in 2010 when I learned that drivers in Santiago, Chile had a chip in their dash that tallied every kilometer driven in the Metro area. At the end of the month, the driver got a digital bill for each kilometer that had to be paid. Didn’t want to pay? His medical benefits were suspended and all kinds of other bad stuff. It seemed way out there dystopian then, but any thinking North American shouldn’t think it’s far-fetched now. We will be ESG-scored and this is being pushed down from world government to big business and then to small business and us. For business, it means less competition for those who can afford the nonsense, and thus greater market share and eventual pricing power. For individuals this is coercive behavioral engineering with the threat of punishment. It’s time for miners to push back and stop being tools enabling the ESG scam. Next time your CEO talks about “decarbonation” and “Net-Zero” call him out. If you’re about to retire or quit anyway, that is. And by the way, Elon Musk says ESG’s a scam, too. So there!

UPDATE: November 2022

There are some gains and some losses since this post was published in August. The faintest squeaks of resistance to the Green wave and the ESG nightmare have emerged from the rank and file minions, the magazines and societies, or at least I can say I am catching up a bit with some good research out there. And there’s more bad stuff coming out, too, not helped by the latest COP27 and G20 meetings.

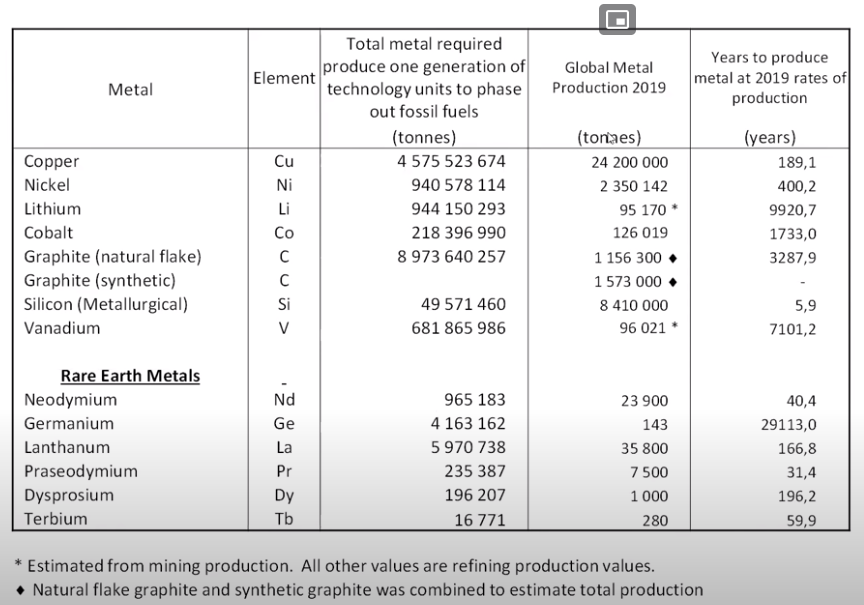

I’d like to thank Viable Opposition (here) for it’s post, “The Major Roadblock to a Fossil Fuel-Free Future“. Among the sources cited, a paper by Michaux entitled “Assessment of the Extra Capacity Required of Alternative Energy Electrical Power Systems to Completely Replace Fossil Fuels” (here and here) provides a wonderful multi-facet data dump on historical and current world energy production and consumption, and an analysis and modeling of future requirements to achieve various alternative energy scenarios. The graph from the seminar summarizing the work is stunning:

Not to worry–the EV part of the lithium requirement is only ~2% of the total, so maybe 200 years supply at current production rates to get to the 2030 – 2040 goal of 100% EV fleet. We can do that, right? Not a chance I’m afraid. The author’s final summary is unequivocal: “Current thinking is that global industrial businesses will replace a complex industrial ecosystem that took more than a century to build. The current system was built with the support of the highest calorifically dense source of energy the world has ever known (oil), in cheap abundant quantities, with easily available credit, and seemingly unlimited mineral resources. This replacement is hoped to be done at a time when there is comparatively very expensive energy, a fragile finance system saturated in debt, not enough minerals, and an unprecedented world population, embedded in a deteriorating natural environment.” His prediction that the reality of our situation will involve a restructuring of economies, society and less energy consumption for all is pretty sobering if you think about what that could mean.

Honorable mention goes to Steve Fiscor, Publisher and Editor-in-Chief of E&MJ whose comments in the September issue of the magazine (here) include: “Let’s talk irony. In the U.S., California mandated all new cars be electric by 2035 and the following weekend asked citizens not to charge them to conserve energy during a period of extreme heat.” And this insightful conclusion: “…a 200% increase in (copper) production in the next 20 years seems…laughable. Without the metals to support it, the great energy transition will not happen.” Kudos to Steve.

A post by Joe Mazumdar on his Exploration Insights blog (here), Fables of the Reconstruction — Flawed road to a carbon-neutral economy, opens with “There is a conflict between the western world’s ambitious climate goals and the path to achieving them.” He presents a lot of data to make a case that we need a lot of minerals for the transition that are mined, processed and refined in only a few countries, that it is increasingly difficult to bring a new project to production, and we are going to use a lot of diesel fuel to do the work. He also points out the feckless approach to supply and demand (subsidies), and lack of coordination of the Western nations. While he makes a plea to fast track (steamroll?) permitting for projects, he also points out the need for increased investment in carbon fuels in the near and medium term. That, of course, is not happening. Besides all the facts, it should be pointed out that the “western world’s ambitious climate goals” as he puts it have not been put to a vote of the western world’s people. Anyway, the article is a good look at some facts of current metals consumption and the roadblocks to increasing it.

Hall of Shame award goes to SME which features a President’s Page message in the November 2022 issue of Mining Engineering (here). This states as fact the following: “Although the Earth’s temperature has been rising the last 10,000+ years with significant melting of glaciers, the rate of heating appears to be increasing since the Industrial Age with carbon dioxide (CO2) being the primary culprit.” I guess there can be no argument since someone said it. CULPRIT! Bad, CO2, Bad. Then it goes on about all of the wonderful “green” energy and things that are happening, like “thousands of acres that are covered with solar farms creating energy…” and sterilizing any life beneath them (this Editor’s note). This is just blatant shilling for the United Nations agenda, repeating nostrums from Big Brother. The writer does acknowledge that there is an availability problem with all of the metals needed to attain the (questionable) goal(s) of green, but the solution is apparently to mine them all here in the good ol’ United States. By golly, more jobs. The article is back-stopped by a message in the back of the issue by the magazine editor. And then inside the issue is an article about how ESG is near, or at the top of the list for mining companies concerns. Is someone getting paid off or is this just sheep talk? Fortunately, these are quick reads and don’t detract from the extended time better spent on absorbing the information in the deep dive done by Michaux and the Geological Survey of Finland, noted above.

UPDATE: December 2022

Propaganda is the executive arm of the invisible government (Bernays, 1928, Propaganda).

One of the tools of effective propaganda is message repetition and reinforcement to break down “sales resistance”. Even if the message is a lie, if it is broadcast enough most people are susceptible enough to brainwashing that they will accept it as truth and defend it to their last breath. This month, these notices from professional societies that I belong to, and who are acting as, I hope, unwitting accomplices of, and propagandists for the U.N. agenda, arrived in my inbox:

MMSA Seminar: ESG – An Overview, Brief History, and Impact on Energy-Producing States

*SEG 2023 Conference: Resourcing the Green Transition

SEG Distinguished Lecturer: Responsible Critical Minerals: Transforming Mining for the Energy Transition

SME Mining Engineering, December, 2022 lead article: Sustainable development across the minerals and metals value chain

SME Webinar: Critical Minerals: New Challenges for Exploration Management

SME Webinar: MISSOURI COBALT MADISON MINE PROJECT – HELPING TO FILL THE U.S. CRITICAL MINERALS VACUUM

*SEG receives early nomination for CRC Bozo Button award, 2023